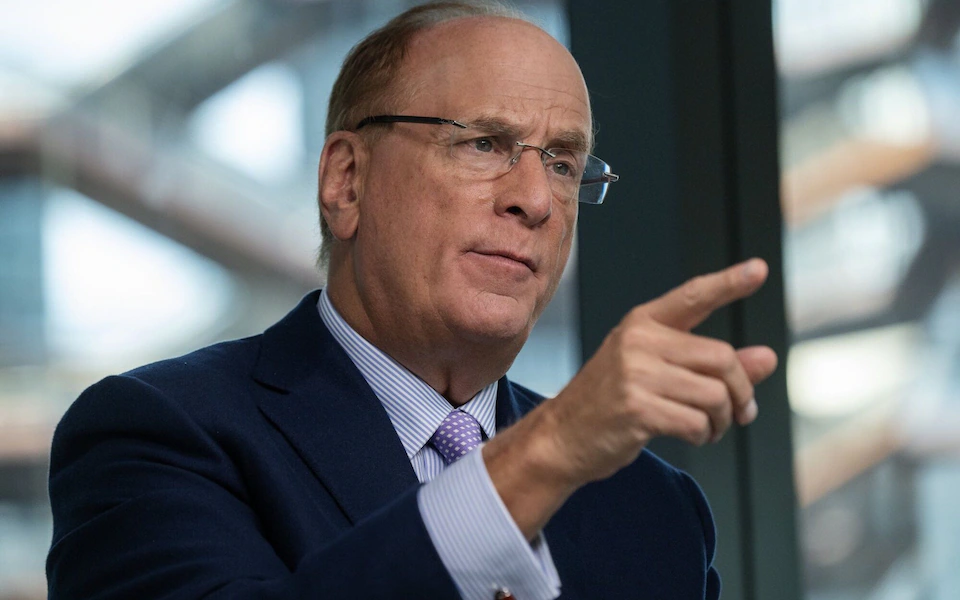

In a time when financial foresight is more critical than ever, Larry Fink, the Chairman and CEO of BlackRock, the world’s largest asset manager, is directing the global conversation toward a burgeoning crisis: the future of retirement. In his insightful annual investor letter, Fink has spotlighted the impending retirement crisis, underpinned by an aging population that could soon present significant economic challenges. As someone at the helm of an entity managing over $10 trillion in assets, half earmarked for retirement, Fink’s perspective on financial health and sustainability commands attention and respect.

Fink’s letter to investors is not merely an observation of the issues but a clarion call for a seismic shift in how retirement is approached globally. Highlighting a disturbing trend, he points out that many countries are on the brink of reaching an “aging tipping point” within the next two decades. Yet, the preparation for this demographic shift is woefully inadequate, with many Americans lacking even essential emergency savings, let alone robust retirement funds.

The crux of Fink’s argument lies in the necessity for an “organized, high-level effort” to ensure future generations can retire with dignity. His suggestions are manifold and pragmatic, from establishing retirement systems encompassing gig and part-time workers to creating pension-like income streams from 401(k) plans. Moreover, Fink broaches the controversial yet critical discussion on raising the retirement age, underscoring the outdated benchmarks that no longer reflect today’s longevity and economic realities.

Fink also ventures into climate-conscious investing, defending BlackRock’s stance on E.S.G. (Environmental, Social, and Governance) amidst political backlash. He advocates for an “energy pragmatism” that balances the immediate need for energy security with the long-term decarbonization goal, highlighting the inevitability of a transition to green energy driven by a global consensus.

As the world grapples with complex financial and environmental futures, Fink’s insights offer a roadmap for addressing these challenges head-on. His call for reevaluating retirement planning and a pragmatic approach to sustainable investment reflects a deep understanding of the interconnectedness of economic health, societal well-being, and environmental stewardship.

Larry Fink’s foresight into the retirement crisis and his advocacy for sustainable investment practices underscore a pivotal moment for global economic policy. At the crossroads of demographic shifts and environmental imperatives, Fink’s warnings and recommendations offer wisdom for navigating toward a more secure and sustainable future. They remind us that the time for action is now, lest we find ourselves unprepared for the inevitable changes.