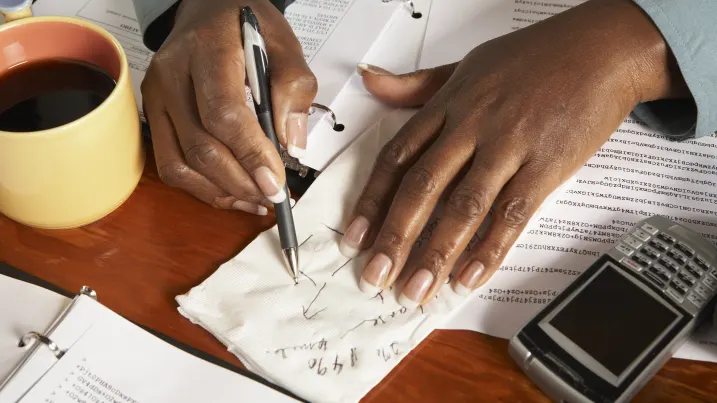

No one wants to be caught off guard with a tax bill. Thankfully, according to experts, there is still time to make adjustments if you haven’t paid enough taxes for 2024. Paying close attention to your withholdings and estimated payments can ensure you’re on track to avoid an unpleasant surprise come tax time. Certified financial planner Tommy Lucas shares some helpful tips for “back of the napkin math” to estimate your 2024 withholdings and ensure you’re paying enough.

Estimating Tax Withholding: A Simple Method

To get started, you can look at your total federal taxes paid in 2023, which can be found on line 24 of your previous year’s tax return. If your income and tax situation has remained the same, your tax liability for 2024 will likely be similar. “If you’ve paid roughly 75% of last year’s taxes by the end of September, you’re going to be pretty darn close,” said Tommy Lucas, certified financial planner at Moisand Fitzgerald Tamayo. This method can give you a rough idea of whether you’re on track for this year.

However, it’s important to note that significant life changes—such as a second job, marriage, divorce, or having a child—can alter your tax situation, so you’ll need to reassess your withholdings more carefully.

Using the IRS Tax Withholding Estimator

If your financial circumstances have changed, experts recommend using the IRS tax withholding estimator. This free tool considers your marital status, dependents, jobs, and other income sources to provide an updated estimate of your tax liability. By plugging in your current financial data, you’ll receive a pre-filled Form W-4 to submit to your employer to adjust your withholdings.

“You’ve got to keep an eye on it,” warned Mark Steber, chief tax information officer at Jackson Hewitt, “or you could face an unexpected tax bill, along with penalties and interest.”

Making Sure the Changes Reflect Accurately

Once you submit an updated Form W-4, verifying that your new withholdings are reflected in your paycheck for the rest of the year is crucial. This ensures you are not withholding too little or too much. Lucas advises that these changes should only apply through 2024, and you’ll need to submit a new Form W-4 in January to avoid over-withholding in 2025.

By staying proactive and using simple methods to estimate your tax withholdings, you can avoid the stress of a surprise tax bill. Whether you’re using back-of-the-napkin math or the IRS tax withholding estimator, regular monitoring can save you from financial headaches down the line. As Lucas suggests, keeping an eye on your situation ensures you can avoid penalties and have a smoother tax filing process in 2024.