Total gold demand hit a record last year and will continue to rise in 2024, partly due to BRICS countries adopting gold as the basis for international exchange. Adding to the momentum, the US Federal Reserve is moving toward cutting interest rates, which has historically boosted the price of gold. Swiss Bank UBS predicts that gold prices will reach $2,800 per ounce by the end of next year, while a recent survey of 70 central banks reveals that expected gold purchases will continue at record highs.

In the World Gold Council (WGC) survey, no central banks expect a decline in gold purchases, with 81% anticipating an increase. Rising consumer and industrial demand is also expected to drive up gold prices. Gold has already surpassed the Euro in global reserve shares, highlighting its growing importance. The world is beginning its return to a gold standard, and the opportunity to invest in gold has not been so significant in decades.

In the real economy, most essential resources are cultivated or mined. While buying physical gold is a smart investment, investors seeking higher returns from rising gold prices can invest in mining companies like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF). Gold mining and exploration companies leverage technology to maximize output and can grow through operational improvements or acquisitions.

Many gold mining stocks are considered undervalued compared to physical gold and often appreciate in value much faster. In addition, securities are more liquid and can be easily traded.

Central-Bank Buying & Fed Rate Cuts Usher in a New Bull Market for Gold

Gold is widely regarded as a safe-haven asset, but global trends are making it perform like a growth stock. Classic investors purchase gold to offset inflation and geopolitical risk, while some wear it to portray wealth and status. Modern investors are simply buying gold mining stocks to protect and bolster their portfolios.

Central banks are concerned about the perceived value of their currencies and the security of their trade, prompting them to intervene in the gold market. Their interventions and purchasing increased gold’s price by 49% over the past 20 months, reaching an all-time high of $2,427 per ounce in May.

Historical data indicates that gold often sees a seasonal rise starting in July. This trend is driven by increased demand from jewelers for the holiday season and cultural events in gold-consuming countries. Investing in gold stocks or ETFs in July allows investors to capitalize on seasonal demand and the corresponding rise in gold prices.

Unlike stocks or bonds, gold typically moves independently of other asset classes and offers valuable diversification benefits. It often performs best during market volatility, serving as a stabilizing force when other investments decline.

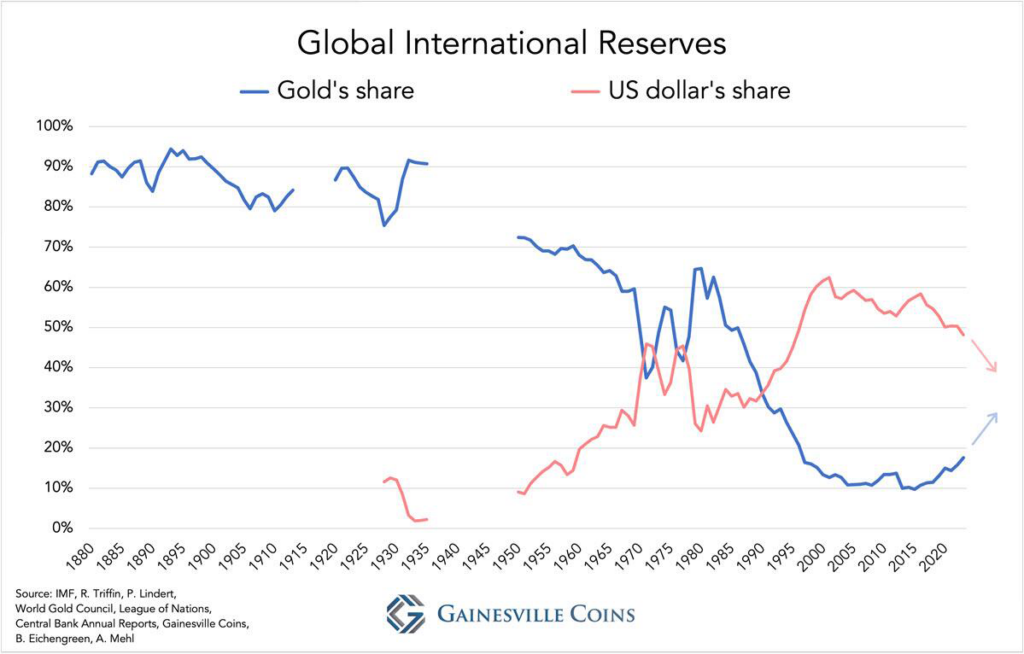

In 2023, gold accounted for 18% of global international reserves, surpassing the euro’s 16%, highlighting a shift in reserve preferences. The next contender is the U.S. dollar, whose share of total reserves dropped to 48% that year. This decline is due to waning trust in fiat currencies amid asset bubbles, escalating conflicts, and inflation fears, while gold is gaining significant ground.

The Canadian Gold Mining Stock to Buy and Hold While It’s Cheap

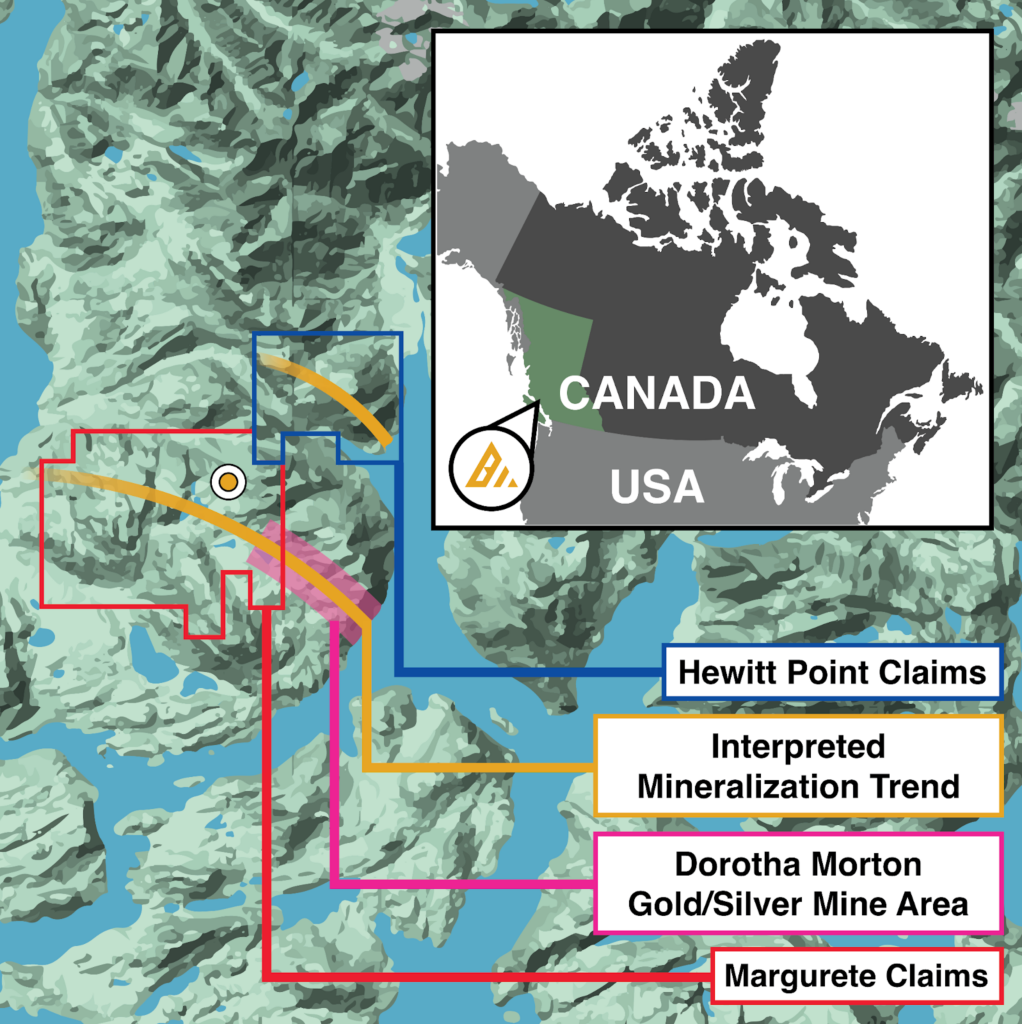

Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a mineral exploration company specializing in uncovering and developing lucrative gold deposits in British Columbia, Canada. The company has experienced extraordinary growth, with its stock price rising 330% since the start of the year and 3,483% over the past twelve months.

Investing in gold mining companies like Bedford offers considerable advantages over direct investments in physical gold. As gold prices climb, companies like Bedford have the ability to scale production and optimize operations to enhance profitability. These operational advantages, coupled with rising gold prices, have typically resulted in these companies’ stock prices increasing faster than the price of gold itself.

Bedford’s remarkable gains over the last year exemplify the positive impact of rising gold prices on gold mining stocks. The company is advancing operations, particularly at the Margurete Gold Project in British Columbia. Past explorations have uncovered significant gold findings, including 6.18 grams of gold per tonne at the surface.

British Columbia’s significant gold reserves and favorable mining conditions continue to attract substantial investment from exploration and mining companies. A year ago, industry reports estimated the total value of provincial mining production would reach $15.9 billion in 2023. Bedford’s targeted exploration within the Margurete Property has unveiled positive results, resonating with the historic gold rush that has thrived in the region for decades.

Due to additional investment, the company has expanded into uranium to diversify its asset portfolio, acquiring two projects in Canada’s prime uranium region, the Athabasca Basin in Saskatchewan. This strategic move is done in anticipation of further price growth of the commodity as demand surges, thanks to the adoption of nuclear power as a clean energy source.

Bedford Metals’ strategic decisions have put it on track to reap the rewards of increasing global gold and uranium demand. Its veteran management team has chosen sites with abundant mineralogical potential in world-renowned areas that have produced gold and uranium ore for decades.

The recent bull markets for gold and uranium highlight the insufficient supply of these metals to meet economic demands. Growth stocks like Bedford Metals continue to thrive by addressing this long-term supply constraint.