If your portfolio isn’t sitting on a gold mine, now is the time to invest in one. The long-term trend has been clear over the last 20 years: Gold is consistently becoming more valuable than US dollars, and the speed at which it appreciates is growing. Despite multiple record-high prices this year, gold stocks remain undervalued, offering a prime investment opportunity as they surge to catch up after initially lagging behind gold’s price growth.

Gold is experiencing its third significant bull market since decoupling from the U.S. dollar in 1971. The first major surge occurred from 1971 to 1980, with prices skyrocketing 2,700%. The second phase lasted from 1999 to 2011, during which gold prices increased by 670%. The present bull market began in December 2015 at $1,050 per ounce. Since then, gold has climbed nearly 130%, reaching recent levels above $2,300 per ounce.

On July 17, gold prices hit another record high of over $2,470 per ounce. This price rally is expected to continue through 2024. Analysts at Citigroup (NYSE: C) expect the price to be at or above $3,000 in the next 12 months, while Goldman Sachs (NYSE: GS) forecasts prices to hit that range by year-end.

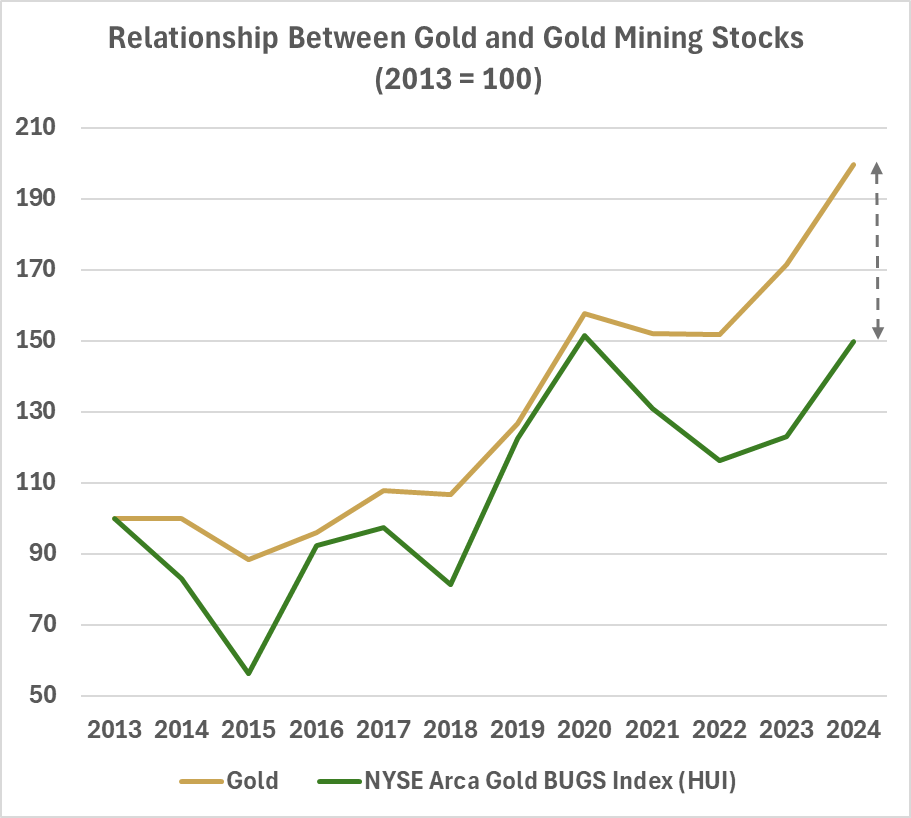

Major investment banks agree that we are entering the critical phase of the gold bull market, where pullbacks become brief and infrequent. JP Morgan analysts report that the ‘structural bull case for gold remains intact,’ highlighting gold as their top pick in commodities markets. Gold stocks remain undervalued relative to the gold they mine, offering a profitable investment opportunity as gold prices continue to rise.

With the industry’s bright prospects, investors should consider fundamentally solid gold mining stocks like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF). The company is a top-performing gold stock thanks to its strategic location, experienced management team, and growth-oriented strategy. The company has already experienced an impressive return of 3,900% over the past 12 months, with indicators suggesting potential for further growth.

Gold Surpasses S&P 500: Price Surge Suggests New Highs and Equity Gains

After peaking in May, gold prices stayed above $2,300 per ounce before setting a new record in July. With this growth, gold has outperformed the S&P 500 over the past six months. Gold price trends significantly impact miners’ profits, and their stock prices reflect these earnings, leading to increased value as the gold they mine appreciates.

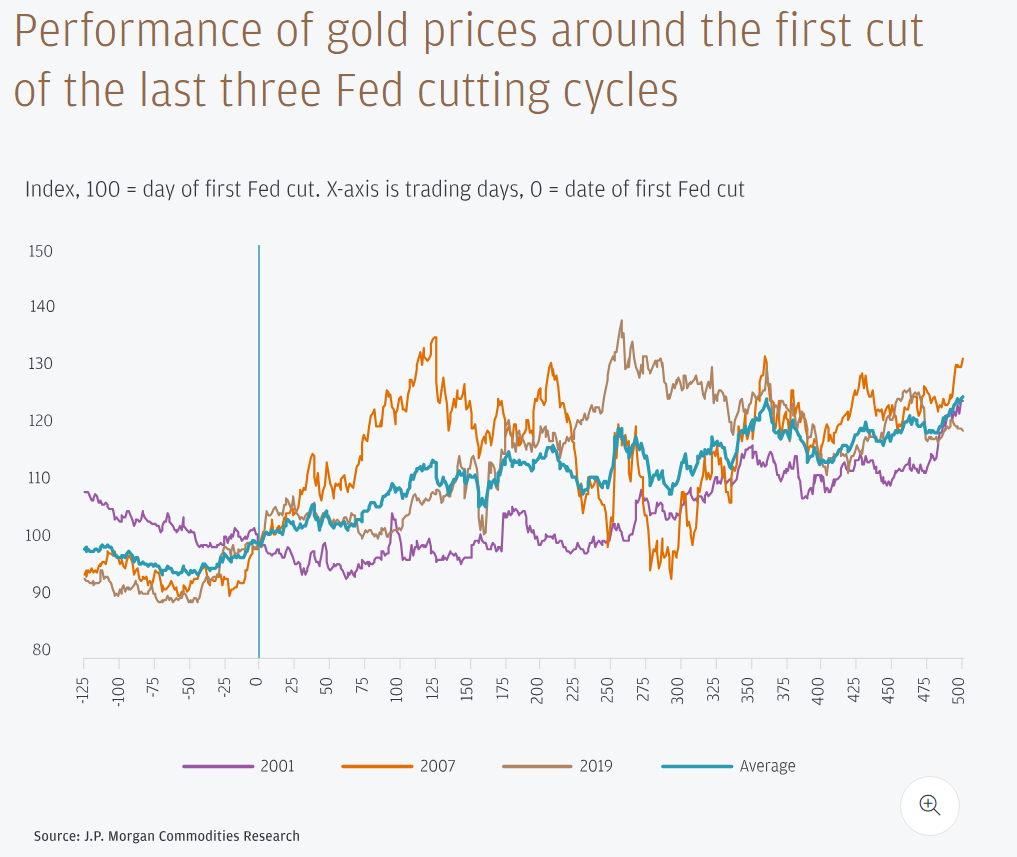

Gold’s 2024 rally came “quicker than expected,” according to JP Morgan’s Head of Base and Precious Metals Strategy, Gregory Shearer. The upward price adjustment coincides with the anticipation of Fed rate cuts and the rise of U.S. yields due to stronger labor and inflation data.

If we look at the Fed rate-cutting cycles in 2001, 2007, and 2019, gold prices have consistently risen:

Central banks have played a major role in driving gold prices by buying 1,037 tonnes in 2023. This trend continued into 2024, with 290 tonnes bought in the first quarter, marking the fourth strongest quarter since the buying spree began in 2022.

Central banks and other buyers of physical gold are expected to continue purchasing, which will help keep gold prices high. Investment banks have frequently updated their positive forecasts because gold prices have consistently set new records nearly every month since March.

Historically, gold equities have performed strongly in response to rising gold prices. Due to unprecedented gold prices and lower mining costs, gold miners are expected to report their best quarterly results. Junior miners often outperform larger competitors due to their higher growth potential and smaller market capitalizations, leading to rapid stock value increases as gold prices rise.

Gold stocks are well-positioned for substantial gains, supported by rising prices and strong market fundamentals. Mining sector outperformers like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) demonstrate that they are well-positioned with strategies to turn higher gold prices into better cash flow and returns, leading to growth.

Want to Invest in Gold? Here’s the Best Gold Stock To Buy in 2024

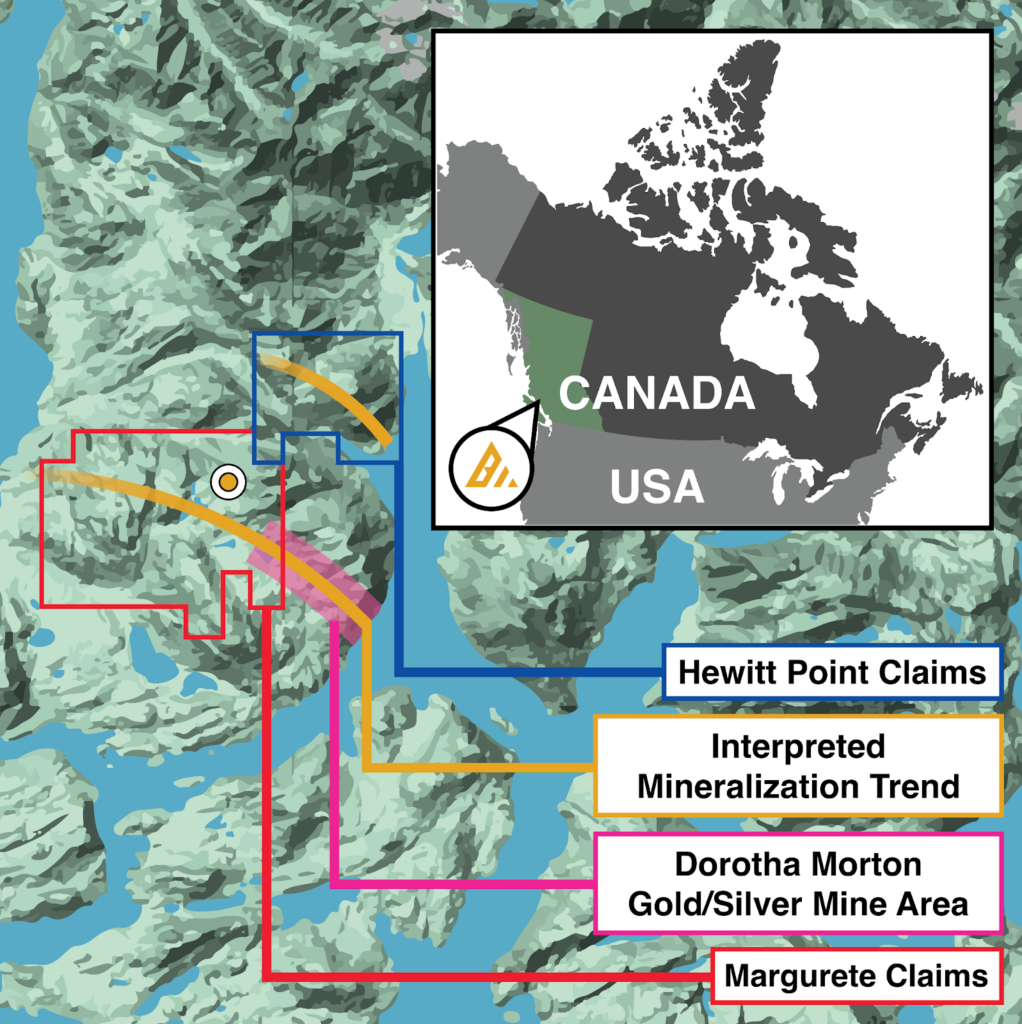

Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a mineral exploration company specializing in uncovering and developing gold deposits in British Columbia, Canada. The company has experienced extraordinary growth, with its stock price rising 300% since the start of the year. Despite its surge, the company remains affordable and has room to grow in 2024 as gold prices approach $3,000.

The company is advancing operations, particularly at the Margurete Gold Project in British Columbia. Past explorations have uncovered significant results, including findings of 6.18 grams of gold per tonne at the surface.

British Columbia’s favorable mining conditions and abundant gold reserves continue to attract significant investment for exploration and mining companies. The government recently invested C$195 million (US$142.6 million) to upgrade highway infrastructure in the Golden Triangle, benefiting the mining industry.

Bedford Metals’ strategic decisions have put it on track to reap the rewards of record-breaking gold prices. Gold’s current bull run is not just about Fed rate cuts, bank purchases, or the US dollar. It’s about the companies producing it and early investors recognizing their true value before the wider market does.

Stocks like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) are still growing, despite their massive past growth, as they align with the rise in gold prices. Early investors who buy while the price is affordable will reap the highest rewards.