Tech giants like Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) are becoming major investors in nuclear power plants to ensure reliable and clean energy for their data centres. The need for energy sources near cities has boosted nuclear power demand and increased uranium prices significantly over the past year.

While Silicon Valley invests heavily in AI data centres, tech giants will have to face a bottleneck in energy supply. Data centres require vast amounts of electricity, water for cooling, and a highly skilled workforce which prefers to live in and around established cities. To expand, tech companies are investing in nearby power infrastructure instead of relying on distant or unreliable sources like wind farms or solar plants.

Tech firms and their founders, like OpenAI CEO Sam Altman, have been investing in nuclear energy for years with reactor technology companies like Oklo (NYSE: OKLO). Similarly, Amazon bought a nuclear-powered data centre neighbouring a plant in March for $650 million.

Recently, Microsoft is reportedly preparing to build a massive $100 billion data centre named ‘Stargate.’ Morgan Stanley analysts believe several nuclear plants will be needed to power the new data centre in the U.S.

Uranium prices have tripled in five years due to advancements in reactor technology, stronger demand, and more investment. Investors looking to cash in on this bull market should consider undervalued uranium companies like Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF), which stand to benefit the most from this rising demand.

Investors Bullish on AI Cannot Ignore Uranium Stocks

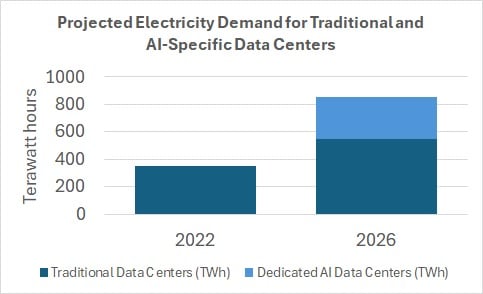

If AI server requirements continue at their current pace, they will need to consume over 85 terawatt hours of electricity annually, which exceeds the consumption of countries like Belgium or Austria. The demand for on-site and localized electricity generation for AI operations is literally life or death for AI.

As of 2023, 60 new nuclear reactors are under construction worldwide, with plans for an additional 100. Large companies cannot wait. The pace of AI development is surpassing the energy supply in regions. With no other good options except for nuclear, this situation will foster positive developments and boost the sector’s growth as demand rises.

Microsoft’s pursuit of nuclear-powered solutions for its computing needs reflects a broader trend in the tech industry. Its planned Stargate endeavour is not the first instance of the company pivoting to nuclear energy to power its data centres.

Last summer, Microsoft struck a deal with Constellation Energy to supply one of its data centres in Virginia with nuclear power. This year, Microsoft is going all in, having hired a director of nuclear technologies to oversee a program to develop small-scale atomic reactors to power its existing data centres.

The International Energy Agency (IEA) reported that by 2026, AI workloads could double the electricity use of data centres, matching Japan’s current energy consumption. For context, a single ChatGPT query has been estimated to require as much electricity as 15 Google searches.

Uranium prices have already reflected this, with an upward price adjustment leveraged on heightened demand for the past five years. In the last 12 months, uranium prices have increased over 50%, with many mining companies like Bedford Metals following impressive stock gains in the same period.

Investors bullish on AI can profit from uranium stocks by capitalizing on the increasing demand for nuclear energy driven by AI’s growing power requirements. As tech giants turn to nuclear power to fuel their AI advancements, the need for uranium, the key fuel for nuclear reactors, is set to soar.

This presents a prime opportunity for investors looking to gain exposure to the uranium market by investing in companies like Bedford Metals before their value surges further.

The Golden Opportunity to Invest in an Undervalued Uranium Company

Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) has emerged as a notable stock in the uranium sector. Its stock value has skyrocketed significantly by 4,200% over the past year and 330% year-to-date. As market prices for uranium grow, the company’s stock is projected to continue its upward trend.

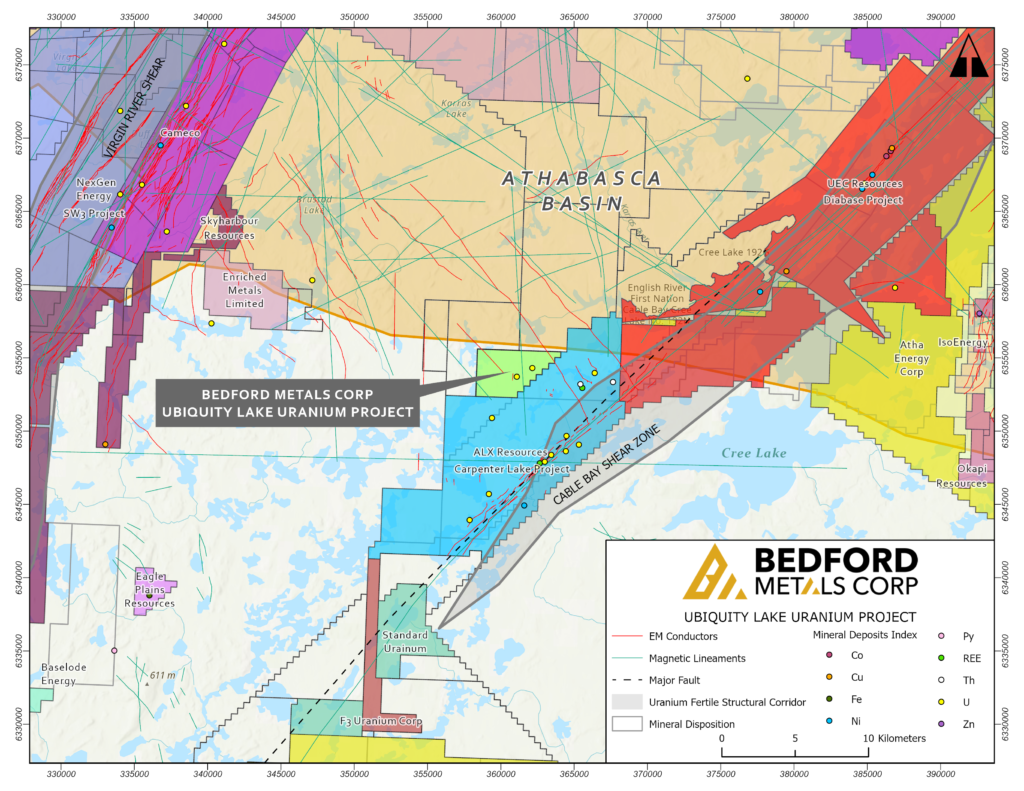

The company recently expanded its portfolio by acquiring the Ubiquity Lake Uranium Project in Canada’s Athabasca Basin, a key area for uranium production. Bedford is also seeking to continue acquiring strategic uranium projects in the region. The company also has a great track record with gold mining and exploration, pushing the stock up during gold’s ongoing two-decades-long bull run.

The Ubiquity Lake Project is adjacent to major uranium projects such as ALX Uranium‘s Carpenter Lake Project and Uranium Energy Corp’s Diabase Project.

Positioned near crucial geological structures like the Cable Bay Shear Zone and the Virgin River Shear Zone—close to Cameco’s (TSX: CCO) Centennial uranium deposit. The project has strong potential for major uranium discoveries near significant deposits.

The company’s Margurete Gold Project spans 687 hectares in southwest British Columbia, northwest of Vancouver, Canada. The project has already obtained promising results, including surface findings of 6.18 grams of gold per tonne.

With the AI industry seeking to boost nuclear power to fuel itself, uranium prices are going to rise. It may be too late to profit massively from some of today’s most successful AI companies; however, it’s still early to invest in companies that will power them.