When it comes to finding stocks he’s into, Warren Buffett is the master of value investing — buying stocks from companies trading below their intrinsic worth.

While most people fixate on the short-term ups and downs of the market, the world’s best investors buy undervalued stocks, keep investing through thick and thin (especially thin), and hold them practically forever.

To follow Buffett’s wisdom, we encourage our readers to invest a set amount into their diversified portfolio regularly. This ensures you buy fewer shares when stocks are pricey and more when they’re on sale and are ready to hold for the long term.

Recently, the market faced a selloff driven by concerns about interest rate cuts and a weaker-than-expected U.S. jobs report. But for long-term investors, that’s irrelevant.

“If you’re worried about corrections, you shouldn’t own stocks,” Buffett said during an interview with The Street.

Ignore the short-term market fluctuations. View them as opportunities. Times like those are perfect for adding long-term value investments to your portfolio.

Here are five value stocks you should buy and hold forever:

- Bedford Metals

- Nvidia

- Berkshire Hathaway

- Microsoft

- Coca-Cola

1. Bedford Metals

With more nuclear reactors being built worldwide, demand and prices for uranium have spiked (prices up over 40% in the past year), making its mining industry a lucrative market for those who know where to invest. Following Buffett’s value strategy, now is the perfect time to jump in.

Undervalued exploration and mining companies like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF) offer the cheapest, most lucrative opportunity to enter the market with expected quadruple-digit returns in the long run as the industry continues to grow due to ever-growing demand.

Bedford Metals’ stock has surged more than 2133% in the past 12 months and 302% year-to-date, driven by acquisitions and ongoing successes on its gold and uranium projects. The stock has plenty of growth potential left, with three recently acquired uranium projects in Canada’s Athabasca Basin, the largest high-grade uranium region in the world.

Bedford’s acquisition of its Ubiquity Lake, Sheppard Lake, and Close Lake uranium projects positions it next to industry leaders like Cameco, which operates the nearby McArthur River Mine, the world’s largest high-grade uranium deposit.

The region is seeing increased mergers and acquisition activity, with bigger players acquiring junior miners to meet production demands. Most recently, Paladin Energy acquired a junior exploration company, Fission Uranium, for C$1.14 billion, highlighting the acquisition and merger activity in the area.

Bedford Metals is poised for even greater success. With projects close to top-producing mines, expectations of positive exploration results with subsequent acquisitions are high. According to its recent press release, the company’s recent satellite surveys revealed markers of uranium mineralization, prompting a ground team to prospect high-value targets on August 6.

Companies like Bedford often outpace the growth of the commodities they mine. Investors should invest before positive exploration results and uranium demand further boost its price.

2. Nvidia

Over the last five years, Nvidia (NASDAQ: NVDA, FWB: NVD) shares have increased 2,500%, prompting a 10-for-1 stock split in June to make shares more accessible. Nvidia’s stock took a hit from its summer peak, yet it has more than doubled in 2024. After nearly a 150% surge in the year’s first half, the stock rebounded beautifully after its recent dip.

For long-term investors, this dip should be regarded as valuation concerns rather than core business issues and can be mostly attributed to day trader panic selling.

In the past three years, Nvidia’s stock price has soared over 400%, with diluted EPS up more than 500%, keeping its valuation rather reasonable despite the massive growth.

Nvidia, initially famous for graphics chips used in gaming, now powers most AI applications. The stock might seem pricey if demand for its AI GPUs drops or competition tightens margins, but such scenarios seem unlikely. Nvidia dominates the AI chip market with an 80% share, which is crucial in today’s AI-friendly markets.

The market will ultimately determine Nvidia’s worth, but until Nvidia’s obvious dominance changes, its intrinsic worth makes it a solid buy, especially on the dip from its summer highs.

3. Berkshire Hathaway

CNBC reports that Berkshire’s (NYSE: BRK.A, NYSE: BRK.B, FWB: BRYN) stake in Apple dropped to 400 million shares in June 2024, a significant reduction from 905 million in December 2023. Instead, Buffett has repurchased Berkshire Hathaway stock in the last three quarters, spending $5 billion on buybacks.

This isn’t him tooting his own horn. It’s clear that Buffett believes Berkshire is undervalued, even after rising over 25% this year.

Berkshire Hathaway owns subsidiaries in diverse industries, including insurance, railroads, energy, utilities, manufacturing, and retail. The core insurance business generates investable cash, which Buffett has historically turned into impressive returns. Berkshire’s book value per share, a solid indicator of intrinsic value, has compounded at 12% annually over the past five years, nearly matching the S&P 500’s 13.1% gain.

Resilience is another of Berkshire’s key strengths. Buffett, as we know, is a master at identifying competitively advantaged businesses and has handpicked its subsidiaries. This diversity means Berkshire isn’t overly reliant on any single sector or industry.

The company reported solid financial results for the June quarter. Revenue increased by 1.2% to $93.7 billion, and operating earnings rose 16% to $11.6 billion. The insurance segment was solid, with operating earnings from underwriting and fixed-income investments climbing 56%. However, earnings generally declined across other segments.

Wall Street expects Berkshire to grow operating earnings at 12% annually over the next three years. While the current valuation of 22 times operating earnings may seem high, Buffett’s actions speak volumes. Berkshire Hathaway is a compelling choice for those seeking to fortify their portfolio with a defensive stock.

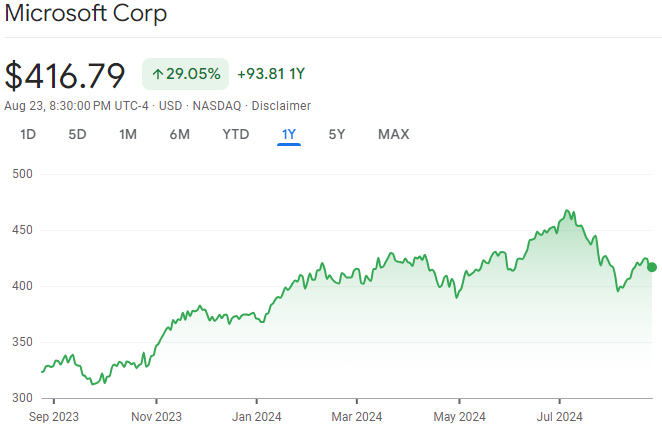

4. Microsoft

Microsoft (NASDAQ: MSFT, FWB: MSF) has been at the forefront of artificial intelligence (AI), so investors were disappointed when its Azure cloud computing business fell short of analyst expectations in fiscal Q4. After a strong run through early July, the stock dropped slightly and is now up only about 12% year-to-date.

However, the stock is a buy even after the pullback from its July highs.

Azure, the company’s cloud computing platform, saw 29% revenue growth year over year. Although this was at the low end of Microsoft’s forecast, overall Intelligent Cloud revenue rose 19% to $28.5 billion. Azure AI customers grew by 60% in the quarter, and the platform saw significant increases in subscription and usage rates. Microsoft also introduced new AI accelerators and models.

Microsoft forecasts double-digit revenue and operating income growth for fiscal 2025, with capital expenditures expected to be higher than in fiscal 2024. For Q1, Microsoft anticipates revenue between $63.8 billion and $64.8 billion. The Intelligent Cloud segment is expected to grow between 18% and 20%, with Azure growth of 28% to 29% in constant currency. The Productivity and Business Processes segment is projected to grow between 10% and 11%, while More Personal Computing is forecasted to grow between 9% and 12%.

The slightly lower-than-expected revenue growth from Azure is related to capacity constraints rather than AI demand issues. The Azure business remains robust and continues to lead the company’s growth. Microsoft’s investment in infrastructure is essential to keep up with demand and capitalize on AI opportunities.

Investing in Microsoft now, amid some near-term selling pressure, could be a great strategic move. In the long term, Microsoft appears poised to be a significant player in AI, making it a solid buy.

5. Coca-Cola

Coca-Cola (NYSE: KO, FWB: CCC3), the world’s leading beverage producer, has successfully shifted much of its bottling to third-party partners, allowing it to focus on its core strength: marketing. This move has increased the company’s profit margins, positioning it well even if economic growth slows. Consumers are unlikely to give up their favorite drinks, and in more challenging times, they may even indulge in these affordable treats more often, as seen during past recessions.

Coca-Cola remains a substantial investment, with analysts rating it a buy and a target price above its current level. However, its appeal lies in its reliable dividends, especially as economic uncertainties loom.

With a forward-looking dividend yield of 2.8% and a history of 62 consecutive years of dividend increases, Coca-Cola offers stability and income potential that few other stocks can match.

In a time of economic uncertainty, buying a quality stock like Coca-Cola will protect your portfolio. Coca-Cola’s consistent revenue, earnings growth, and unwavering dividend record make it a solid choice, regardless of market conditions.

Disclaimer

The information provided on this website does not constitute investment advice and is for informational purposes only. All content, especially market analyses and forecasts, represent the author’s personal opinions and may prove inaccurate. Investments in securities are associated with risks, including the potential total loss of the invested capital. Readers are fully responsible for their investment decisions and should seek comprehensive information and, if necessary, professional advice before investing. TheMarketsWatch Inc. assumes no liability for any losses from using the information provided.