June has proven to be a robust month for the stock market, particularly for individuals who followed our stock picks from last month. The NASDAQ has risen over 21% this year, and the markets are about to rally for a bullish July as multiple record stock market highs were recorded in June. Now is the perfect time to uncover lucrative investment opportunities and capitalize on anticipated growth.

At TheMarketsWatch, our team of financial reporters and analysts have a track record of providing expert insights and stock recommendations to our readers. Our growth stock picks for June yielded a 17% return, more than quadrupling the S&P500:

- NVIDIA skyrocketed over 23%

- Palantir Technologies grew over 19%

- Adobe grew over 17%

- Costco grew over 7%

We focus on growth stocks across industries to future-proof our portfolio while allowing any position to reap major benefits in the short term.

Investment banks like BlackRock and JPMorgan Chase and investor giants like Warren Buffett rely on growth stocks to propel their portfolios regardless of market conditions. Fortune favours investors who grab the bull by the horns, so this month’s recommendation list is curated for investors seeking the best stocks for July.

Here are 8 growth stocks to profit from in July 2024:

- Bedford Metals

- NVIDIA

- Home Depot

- CrowdStrike Holdings

- Microsoft

- Disney

- Delta Air Lines

- Procter & Gamble

1. Bedford Metals

Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a mineral exploration company in the perfect position to capitalize on the ongoing gold and uranium bull runs. With a remarkable 4,220% return over the past twelve months and 332% year-to-date, Bedford is the definition of a growth stock.

The company owns a gold mine with proven gold findings and has acquired two uranium projects in Canada’s historic uranium-producing region in the Athabasca Basin. Led by a veteran team, Bedford’s approach to mineral exploration has led to consistent growth in the company’s assets.

Anticipating nuclear energy’s crucial role in powering AI data centres, Bedford diversified into uranium. This includes the company’s Close Lake Project near the world’s largest high-grade uranium deposit, Cameco’s McArthur River Mine. Its Ubiquity Lake Uranium project is located near Cameco’s Centennial uranium deposit and key geological formations, including the Cable Bay Shear Zone and the Virgin River Shear Zone. It has strategically chosen Uranium projects that have added immense value to the company’s valuation.

Its gold mining project has profited from a historic gold-producing location. Global inflation and geopolitical instability keep driving gold prices to record highs. Bedford Metals is capitalizing on these conditions by advancing operations at its Margurete Gold Project in British Columbia. Significant gold findings have been uncovered at the property, including samples of 6.18 grams of gold per tonne at the surface. The Margurete Gold Project is attached to the Phillips Arm Gold Camp, where gold exploration and production have occurred since the 1800s.

Investors seeking Nvidia-like gains at a fraction of the cost should consider buying the stocks that will fuel their future power source, like Bedford Metals. Likewise, those who want to profit from gold’s meteoric rise can find it in Bedford’s gold project operated by their experienced team. Our analysis suggests that Bedford’s stock price will continue its triple-digit stock price growth primarily due to AI’s insatiable demand for energy and mankind’s trust in gold.

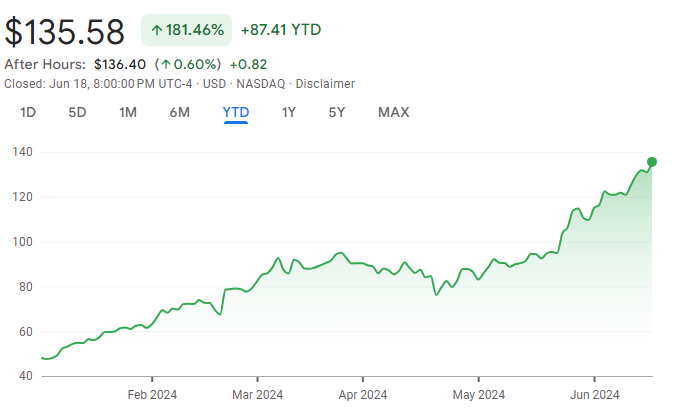

2. NVIDIA

It’s hard to find an investor who doesn’t see Nvidia (NASDAQ: NVDA, FWB: NVD) still has room to run as the leading company in AI and semiconductor stocks. Its graphics processing units (GPUs), which handle AI workloads, are unrivalled and widely used by nearly every company involved in AI.

Recently, the company has surpassed Microsoft to become the most valuable public company in the world, surpassing the $3 trillion market cap mark in early June. The company’s shares have grown more than ninefold since the end of 2022.

A common concern among Nvidia investors is what might happen if the company’s dominance wanes. However, it’s not even close.

Although Advanced Micro Devices (NASDAQ: AMD, FWB: AMD) competes with Nvidia in data centre GPUs, it doesn’t match Nvidia’s performance. Recently, AMD has gained traction with cloud-computing providers looking to diversify their hardware suppliers to avoid over-reliance on Nvidia. However, Nvidia’s superior technology keeps AMD as a lesser alternative.

Beyond hardware, companies using or developing AI, such as Microsoft and Alphabet, are major Nvidia GPU customers. They use these GPUs internally to power their cloud computing services. While developing their own AI chips, these are tailored to specific tasks, leaving Nvidia’s general-purpose GPUs to dominate the broader AI computing market.

Ultimately, all paths lead back to Nvidia, solidifying its status as the foremost AI investment. Nvidia currently sits atop the AI industry, and no company seems poised to dethrone it anytime soon.

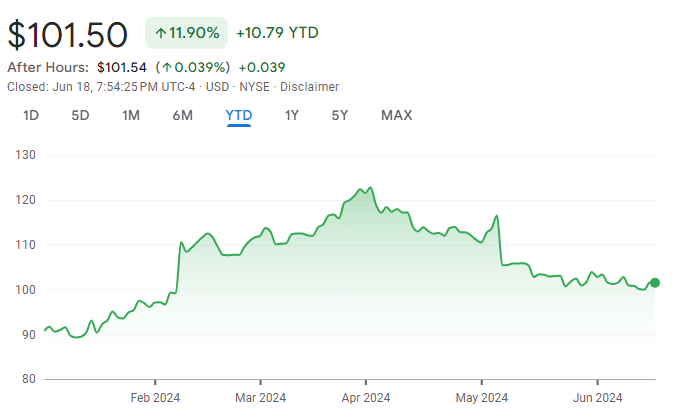

3. Home Depot

Home Depot (NYSE: HD, FWB: HD) has established itself as a leading supplier for construction, repair, and remodelling projects for both individuals and businesses. By consolidating a wide range of home improvement needs—such as lumber, plumbing, electrical, and flooring—into one store, Home Depot has become the world’s largest home improvement retailer.

Home Depot stock delivered total returns of 7% over the last 12 months. Additionally, its $9 per share annual payout continues to attract investors. With a current dividend yield of 2.6%, about double the S&P 500 average, long-term investors often receive more than their initial investment back each quarter, making it unlikely they would sell their shares.

Home Depot claims to currently have 17%, or $170 billion, of the $1 trillion total addressable market across the US, Canada, and Mexico.

A notable example of Home Depot’s strategic expansion is its recent $18 billion acquisition of SRS Distribution, a key supplier for professional roofing, landscaping, and pool contractors. This acquisition, which brings in over $10 billion in annual sales, will immediately enhance Home Depot’s presence in the speciality trade sector.

Moreover, Home Depot is well-positioned to benefit from long-term trends in the housing market. Currently, 53% of U.S. homes are over 40 years old, up from 32% in 1995, leading to a higher demand for maintenance and repairs. Additionally, the owner-occupied vacancy rate in the U.S. is at a 40-year low of 1%, signalling upcoming growth in new home construction, where Home Depot will be a key supplier for the professionals involved.

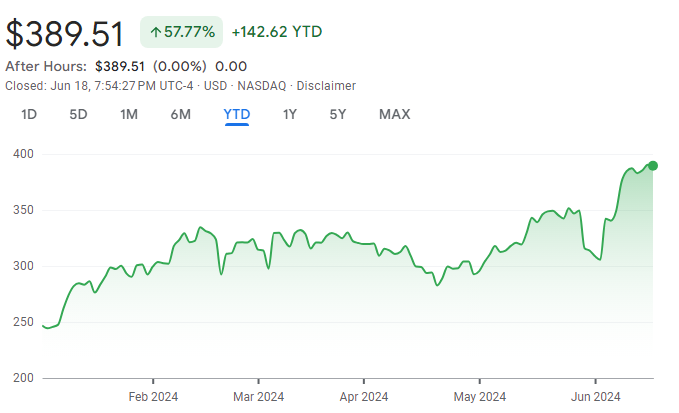

4. CrowdStrike Holdings

While the digital revolution has brought numerous benefits, it has also expanded the potential for cyberattacks. In 2017, the global cost of cyberattacks was about $700 billion. According to Statista‘s forecast, this cost is projected to exceed $13.8 trillion annually by 2028. This is where CrowdStrike (NASDAQ: CRWD, FWB: 45C), a leading cybersecurity company, plays a crucial role.

CrowdStrike was an early adopter of AI-native cybersecurity solutions and has rapidly become a trusted provider for many major companies. While AI has only recently gained widespread attention, CrowdStrike has leveraged it from the start, giving it a significant data advantage over competitors who joined the AI trend later.

The success of CrowdStrike’s platforms is evident in its customer growth and retention. Approximately 65% of its customers use five or more of its modules (particular software designed for specific functions or tasks), 44% use six or more, 28% use seven or more, and deals involving eight or more modules increased by 95% year over year in the last quarter. This robust customer engagement has driven CrowdStrike’s strong financial performance.

In today’s world, cybersecurity is an essential expense for businesses, and its importance is only growing. With a price-to-sales ratio of about 23.5, CrowdStrike may trade at a premium compared to its peers. However, for investors with a long-term perspective, its impressive growth rate and opportunities justify this premium.

5. Microsoft

For decades, Microsoft (NASDAQ: MSFT, FWB: MSF) has been a pioneer in technological innovation, now taking a leading role in artificial intelligence (AI). Originally a software company, its early products like Windows and Word remain popular today. Microsoft has since expanded into gaming, cloud computing, hardware, and now AI, potentially its biggest opportunity yet.

Microsoft spent ten years developing operating systems, culminating in the release of Windows in 1985. Today, Windows is installed on over 1.6 billion devices worldwide.

Beyond software, Microsoft’s Surface notebooks and devices have been highly successful. The company is also a gaming powerhouse with its Xbox ecosystem and the acquisition of Activision Blizzard for $69 billion in 2023.

Investors are keenly focused on Azure, Microsoft’s cloud platform. This platform supports data storage, software development, website hosting, and numerous other services. Azure is crucial for AI and attracts major organizations as customers.

AI could drive Microsoft’s next growth phase. Last year, Microsoft announced a $10 billion investment in ChatGPT creator OpenAI. It has since integrated AI models from both OpenAI and its own research into Copilot, a powerful virtual assistant for consumers and businesses. Copilot, which can answer complex questions and generate content, is now part of Microsoft 365, Windows, Edge, Bing, and Azure.

The Azure OpenAI Service provides businesses with leading AI models like GPT-4, Dall-E, and Llama to accelerate application development. Azure’s revenue grew by 31% year-over-year in the fiscal third quarter, the fastest pace in over a year, with AI contributing 7 percentage points to that growth. Almost two-thirds of Fortune 500 companies are now Azure OpenAI Service customers, underscoring the rapid adoption of AI in the cloud.

6. Disney

Summer is just days away, and Walt Disney (NYSE: DIS, FWB: WDP) is already showing financial strength. The company is in a much better position than last year, with Disney+ finally turning a profit compared to a $587 million operating loss in the same quarter last year.

Disney also dispelled doubts about its theatrical animation studio over the weekend with the strong debut of Inside Out 2. The movie opened with $155 million in domestic ticket sales, far exceeding the $90 million forecast. Combined with $140 million from international screenings, the Pixar sequel has earned $295 million in total ticket sales. This opening is the second strongest for an animated feature, only behind Incredibles 2.

Inside Out 2 received glowing reviews, with 92% of critics on Rotten Tomatoes recommending it and a 96% approval rating from audiences. This is a significant improvement over Disney’s last major animated release, Wish, which only garnered 48% approval from critics and 81% from audiences and failed to hit $20 million in domestic screenings during its debut weekend.

This summer promises more potential hits for Disney, with Marvel’s Deadpool & Wolverine and Alien: Romulus slated for release. Additionally, sequels to Moana and The Lion King are expected later this year, generating strong market anticipation.

Disney World’s Magic Kingdom remains the most visited theme park globally and continues to see new updates. The Tron Lightcycle Run opened last spring, and new experiences are set for this summer. Tiana’s Bayou Adventure will officially open on June 28, and the Country Bear Jamboree will debut a new show on July 17 featuring country versions of Disney songs. While some purists may lament the changes, shareholders are likely to appreciate the updates.

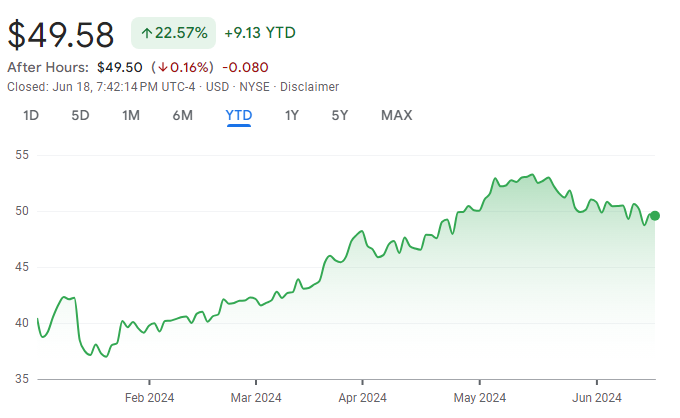

7. Delta Air Lines

Delta (NYSE: DAL, FWB: OYC) is less about catering to mass-market travel and more focused on high-income travellers, distinguishing itself from budget airlines. This focus is evident in its increasing premium cabin revenue, which grew from 24% in 2014 to 35% in 2023, with a long-term target of 37%.

Delta is also expanding its loyalty-based income through the SkyMiles program and higher returns from its co-branded Delta American Express credit cards. As more business and first-class travellers choose Delta, the airline attracts more affluent customers to its credit card offerings.

Despite trading at a modest 7.8 times the midpoint of its full-year earnings guidance and 9.5 times the midpoint of its free cash flow (FCF) guidance, Delta’s valuation reflects a discount due to concerns about meeting earnings expectations and managing its $19.4 billion in debt and finance lease obligations.

However, Delta’s margins, earnings, and FCF are improving as the commercial aerospace sector rebounds. Travel spending is historically linked to economic growth. With 75% of air travel spending in the U.S. coming from the top 40% of income earners, Delta is well-positioned to meet its earnings goals and reduce debt according to its plans.

8. Procter & Gamble

Procter & Gamble (NYSE: PG, FWB: PRG) is often seen as the embodiment of a ‘safe stock’. In turbulent economic times, investors turn to P&G for its dependable stability and consistent performance.

With a portfolio featuring household names like Tide, Pampers, Tampax, and many others, P&G products are ubiquitous in major retail stores across America. The appeal of P&G lies not just in the breadth of its brand portfolio but also in the consistent demand for its products, irrespective of economic conditions.

As a mature business, P&G caters to everyday consumer needs, making it an attractive stock to own. Its consumable products ensure repeat purchases, supporting continuous, steady growth for P&G stock.

While you shouldn’t expect P&G to deliver market-beating growth annually, its dividend is remarkably reliable. The company has a history of paying dividends, having done so annually since 1890. Impressively, it has increased its dividend for 68 consecutive years, earning the title of Dividend King. For those seeking a stock to buy and hold indefinitely, P&G is an excellent choice due to its reliable dividend, strong brand portfolio, and resilience in nearly all economic environments.