Two of the wealthiest investors are taking on China to revolutionize the nuclear energy sector.

Warren Buffett is co-sponsoring a $4 billion Natrium reactor project with Bill Gates’ start-up, TerraPower, which began construction of its first reactor in June. In July, China unveiled its next-generation meltdown-proof reactor, a groundbreaking feat in the field of nuclear energy.

TerraPower’s molten salt reactors (MSRs) are unique because they use salt for cooling and as an energy storage system. The MSR reactor core naturally adjusts its power level to efficiently manage heat removal, thereby meeting energy demand more effectively. The company’s first reactor in Wyoming will feature built-in gigawatt-scale energy storage, making it perfect for stabilizing high-renewable energy grids with fluctuating power output.

The competition to develop the next generation of reactors is global out of necessity. Governments are committing billions to nuclear research to satisfy their energy needs, with China among the most invested. Recently, it successfully demonstrated its first self-cooling reactor in Shidao Bay. The reactor uses helium gas for cooling, allowing the reactor to cool naturally without active intervention.

Billionaires and governments are fueling a nuclear renaissance. Investment in new reactors is already driving up uranium demand. This will support high prices in the long term and benefit companies like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF), which owns multiple uranium projects in Canada’s Athabasca Basin, the world’s highest-grade uranium region.

Uranium prices have tripled in five years due to advancements in reactor technology, stronger demand, and increased investment. Investors looking to cash in on this bull market should consider undervalued uranium companies like Bedford Metals, which stand to benefit the most from this rising demand.

Famous Investors Buy Nuclear Energy Companies: Here’s Why

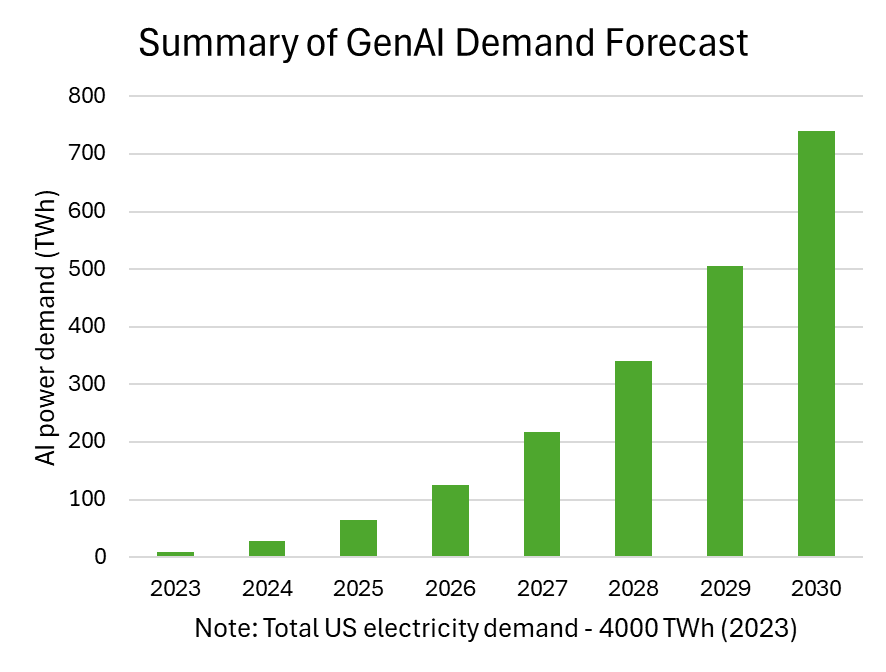

US Secretary of Energy Jennifer Granholm admitted during last year’s IAEA forum that the US must triple its nuclear energy by 2050 to meet its energy goals. At current growth rates, researchers have estimated that some new AI servers could soon consume more than 85 terawatt hours of electricity each year—more than some small nations’ annual energy consumption.

Microsoft founder Bill Gates envisions a cleaner and more efficient energy grid with a new generation of nuclear reactors. TerraPower’s Natrium reactor, a 345-megawatt sodium-cooled reactor, includes advanced molten salt energy storage. Its design uses natural forces like gravity and thermal convection for passive cooling, cutting safety costs compared to traditional reactors. In June, TerraPower started construction on its first Natrium reactor.

According to the IAEA, MSRs benefit from greater energy efficiency and lower waste generation. These reactors can adapt to a variety of nuclear fuel cycles (such as Uranium-Plutonium and Thorium-Uranium cycles), which allow for the extension of fuel resources.

Although TerraPower’s reactors are innovative, they won’t be the only ones deployed with MSR technology. For example, Naarea in France and Thorizon in the Netherlands have signed a strategic partnership agreement to advance the development of MSRs in Europe. Meanwhile, China continues to invest heavily in nuclear technology, a part of its broader push to increase nuclear power and reduce reliance on coal.

Uranium Demand Is Set to Skyrocket This Decade as Competition Fuels Innovation

While molten salt reactors have been developed and are making headlines in the U.S. and Europe, China is already 15 years ahead in terms of nuclear energy technology. The country is now pushing boundaries with its groundbreaking meltdown-proof reactor.

This innovative design uses helium gas instead of water for cooling and replaces traditional fuel rods with graphite spheres containing uranium fuel. This approach significantly reduces the reactor’s energy density, allowing heat to dissipate naturally in the event of a cooling failure.

Retrofitting existing plants with this technology isn’t feasible, meaning a substantial increase in reactor numbers is necessary for widespread deployment. This surge will drive up uranium demand, boost prices, and benefit mineral-rich regions like Canada’s Athabasca Basin.

Uranium Price (USD/Lbs) 2014-2024

The Uranium Stock To Buy As Nuclear Energy Gains More Momentum

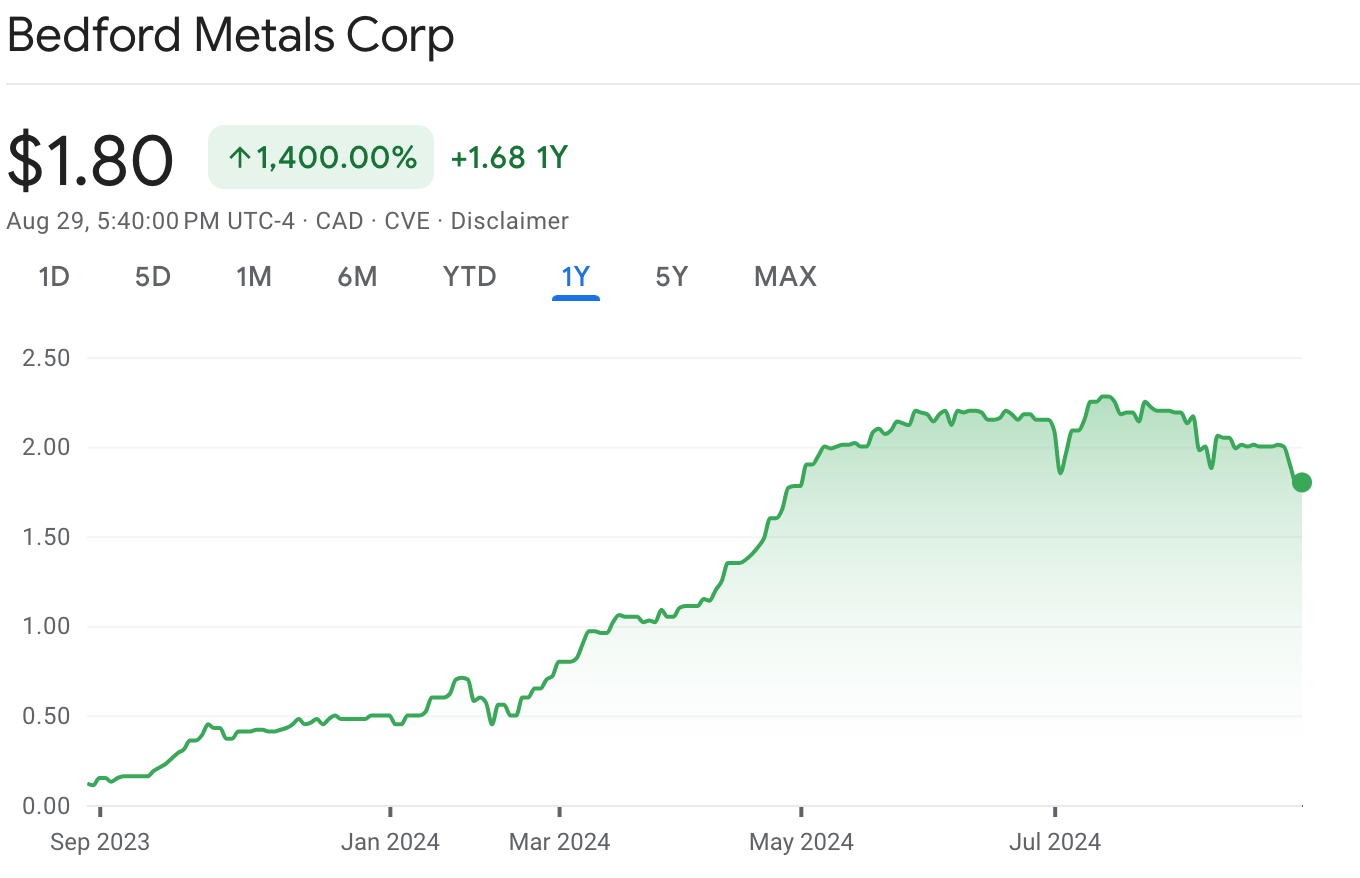

Bedford Metals Corp. (TSX.V: BFM, FWB: O8D, OTC: URGYF) is a junior mineral exploration company with three uranium projects in the Athabasca Basin. The stock is still undervalued and best positioned to take advantage of the current nuclear bull run as next-generation reactors come online around the world.

Bedford Metals’ stock is set for further growth as it advances its projects. It has already surged 1,400% in a year due to strategic acquisitions in the Athabasca Basin. Following these purchases, uranium companies with proven deposits have sold at a premium, like Paladin Energy’s C$1.14 billion acquisition of Fission Uranium. Companies with more advanced projects, such as NexGen’s Rook I, recently valued at C$1.6 billion, continue to see increased valuations.

Bedford Metals owns three high-grade uranium projects that will continue to drive growth:

- The Close Lake Project, located on the eastern side of the Athabasca Basin, sits right next to the Cigar Lake Mine. It is also close to the McArthur River Mine, the world’s largest high-grade uranium mine.

- The Ubiquity Lake and Sheppard Lake projects, situated adjacent to each other in the southern Athabasca region, are near ALX Uranium’s Carpenter Lake Project, Uranium Energy’s Diabase Project, and Cameco’s Centennial uranium deposit.

On August 6, Bedford deployed its ground team to prospect high-value target zones in its Ubiquity Project, previously identified through satellite prospecting and geophysical programs. The entire claim block will be surveyed with scintillometers (used to investigate radioactive target zones), aiming to confirm mineral deposits.

It may be too early to profit massively from companies like TerraPower due to their status as a private company. However, it’s the perfect time to invest in companies that will power their reactors. Smart investors are getting ahead by buying undervalued uranium stocks like Bedford Metals (TSX.V: BFM, FWB: O8D, OTC: URGYF), primed for exponential growth as it provides the uranium TerraPower needs to revolutionize the industry.