In the ever-evolving world of technology investments, Nvidia stands out as a prime example of how early investments in promising tech companies can yield life-changing returns. Back in 2014, Nvidia was primarily recognized for its graphics processors, which were highly popular in the video game industry. Despite the growth potential of video games, Nvidia faced a challenging year, with a notable revenue decline in the second quarter. This led some investors to perceive Nvidia as a company that had reached its maturity. However, those who delved deeper into the company’s capabilities saw something extraordinary.

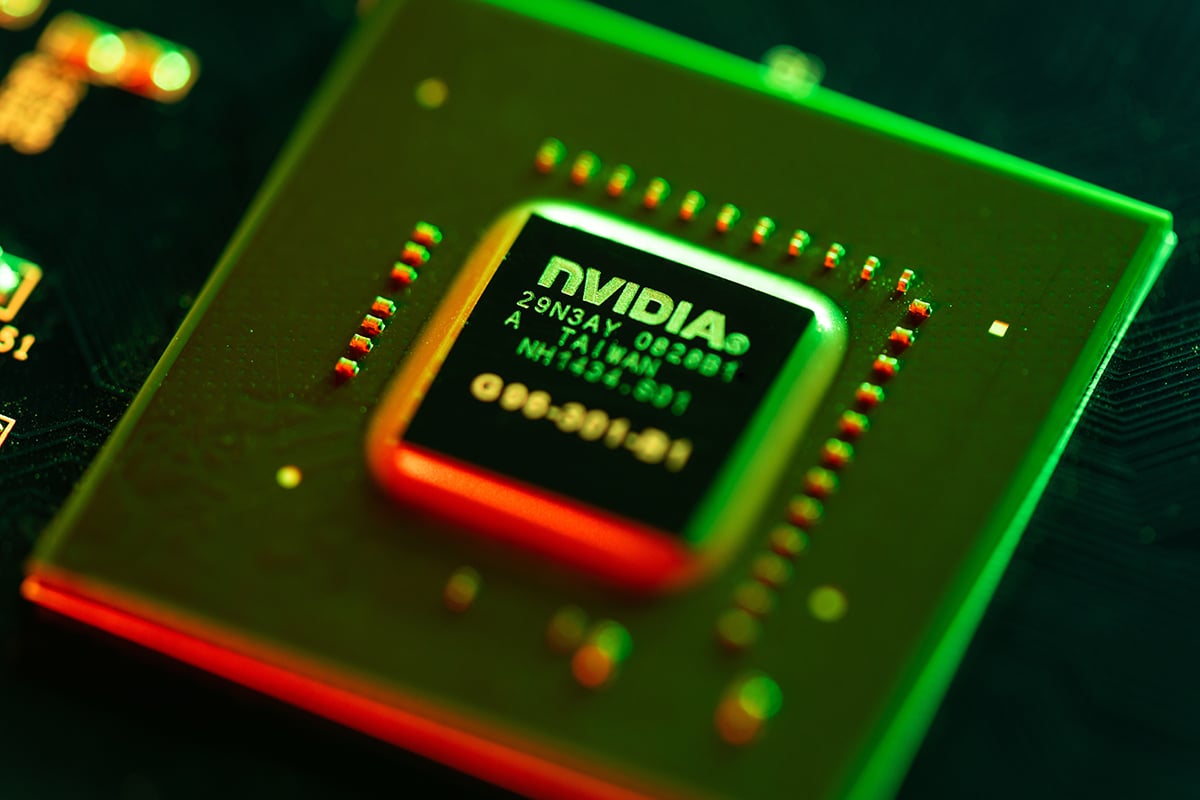

Nvidia had introduced a new software platform called CUDA (Compute Unified Device Architecture). This technology enabled Nvidia’s graphics chips to execute data processing in parallel, allowing multiple calculations to occur simultaneously. In contrast, traditional CPUs processed data in a linear fashion, one calculation at a time. This innovation hinted at the possibility that CUDA-enabled GPUs could one day surpass CPUs as the primary processors in data centers.

Fast forward to today, and the foresight of those early investors has been handsomely rewarded. A $1,000 investment in Nvidia in June 2014 has ballooned to an astonishing $280,600, including dividends. This incredible return represents a gain of 27,960%, transforming a modest sum into a significant fortune. The dramatic increase in Nvidia’s stock value can be attributed to two key developments in recent years.

First, the capabilities of generative artificial intelligence (AI) technology became apparent following the introduction of ChatGPT in late 2022. Nvidia’s GPUs emerged as the optimal hardware for executing the massive number of calculations required to train these advanced AI models. As a result, enterprises around the globe began scrambling to acquire Nvidia’s coveted chips, driving demand through the roof.

This surge in demand had a profound impact on Nvidia’s financial performance. Last quarter, the company’s revenue skyrocketed by 262%, reaching an impressive $26 billion. In stark contrast, Nvidia’s revenue in the second quarter of 2014 was a mere $977 million. The net margin also saw a dramatic improvement, surging to 58.5% from the adjusted (non-GAAP) net margins of 13.6% a decade ago. These figures highlight the transformative growth that Nvidia has experienced over the past ten years.

The success story of Nvidia serves as a testament to the potential rewards of investing in high-growth technology stocks. Identifying and investing in such companies early on can more than make up for a portfolio of mediocre picks, significantly enhancing one’s financial security and independence. While it is challenging to predict which company will become the next Nvidia, the example set by Nvidia encourages investors to keep searching for the next breakthrough.

The technological landscape is constantly evolving, and there are always new opportunities on the horizon. Whether it’s advancements in AI, quantum computing, or another emerging field, the next game-changing technology could be just around the corner. Nvidia’s journey from a struggling chipmaker in 2014 to a market leader in 2024 exemplifies the potential for exponential growth in the tech sector.

For those looking to invest in technology stocks, Nvidia’s story underscores the importance of thorough research and a willingness to take calculated risks. The company’s rise was not a matter of luck but a result of strategic innovation and an understanding of market trends. Investors who recognized the potential of CUDA and Nvidia’s GPUs were able to capitalize on the company’s upward trajectory.

Nvidia’s remarkable ascent over the past decade is a powerful reminder of the rewards that can come from early investments in groundbreaking technology. A $1,000 investment in 2014 has grown into $280,600, thanks to the company’s pioneering advancements in parallel data processing and its pivotal role in the AI revolution. As the search for the next Nvidia continues, investors are reminded to stay vigilant and open to the possibilities that the ever-changing tech industry has to offer.