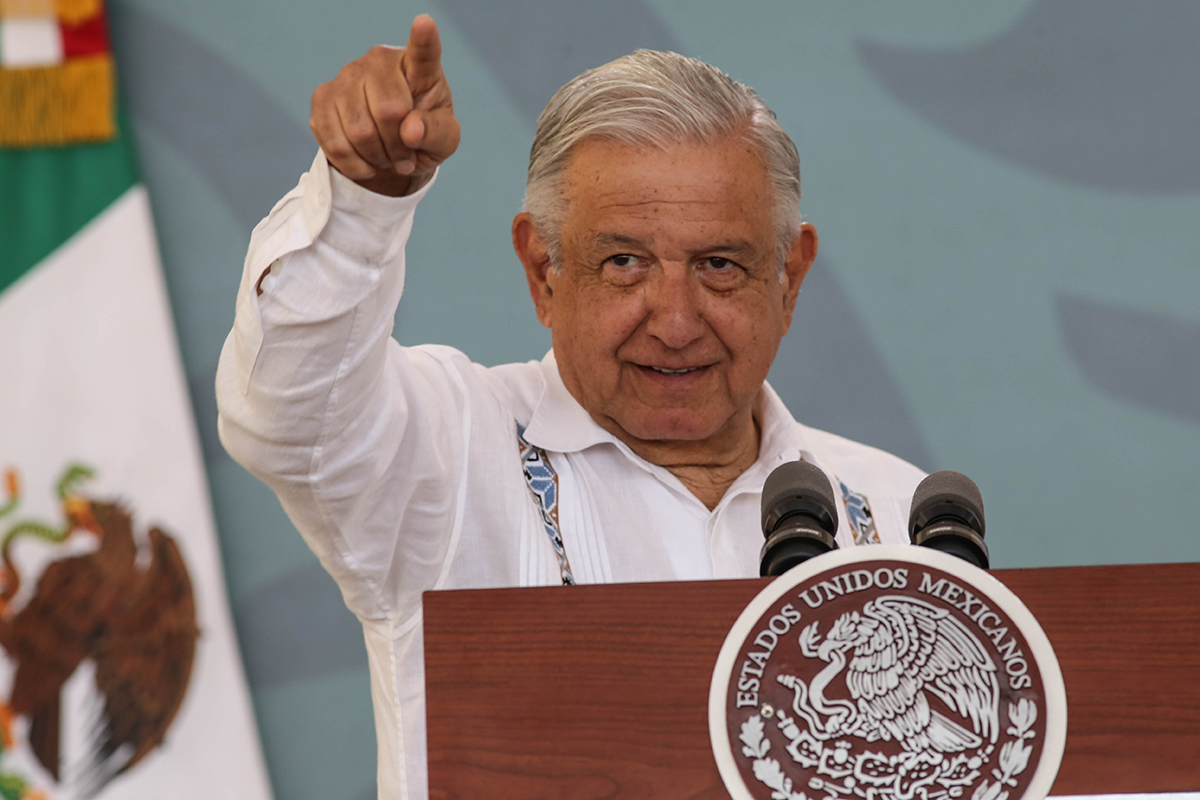

Mexico’s President Andrés Manuel López Obrador (AMLO) is advancing a judicial reform that has sparked fears among investors. The reform, which proposes electing judges through popular vote, is seen as a move that could consolidate power in the ruling Morena party, potentially shifting the balance of power across all branches of government. Concerns are mounting that this could harm Mexico’s investment climate, with economic analysts warning it could reverse years of growth and political stability.

For much of AMLO’s presidency, the courts have acted as a counterbalance to his administration, offering a path for businesses to challenge policies like aggressive tax reforms and energy laws that prioritize nationalization. However, with this judicial reform nearing approval, many fear that the ability to contest governmental decisions will disappear, leaving foreign and domestic investors without legal recourse.

Although the reform has passed the Senate, it now awaits approval from state legislatures. With Morena’s widespread support, critics argue that the reform removes the final check on executive power. Some have drawn parallels between AMLO’s agenda and the political dominance of the 1970s, when the Institutional Revolutionary Party (PRI) concentrated power in the executive branch, nationalizing industries and stifling opposition.

The peso, which had been performing well earlier in the year, has weakened by over 14%, reflecting investor uncertainty surrounding the country’s economic stability. While the reform is aimed at democratizing the judiciary, many fear it could result in legal unpredictability, deterring foreign investment.

Global corporations, including Nestle and AT&T, have expressed concern over the proposed changes, stating that legal uncertainty could influence their future investment decisions. Mexico has become a key player in global supply chains, especially through nearshoring opportunities that have attracted companies relocating closer to the U.S. market. Should confidence in Mexico’s judicial system diminish, other countries could emerge as more attractive destinations for investment.

For smaller businesses, the impact may be less immediate, but large multinational corporations have already begun reconsidering their investments in the country. In response, international ratings agencies like S&P Global Ratings have signaled that they are closely watching how these judicial reforms might affect Mexico’s economic outlook. Although Mexico’s credit rating remains stable, analysts are concerned that a downgrade could be on the horizon if the reforms lead to unfavorable conditions for investors.

Further compounding concerns, Mexico’s lower house of Congress is currently reviewing another law that would dissolve several independent regulatory agencies, including commissions responsible for economic competition, energy, and telecommunications. These agencies would be absorbed into government ministries, potentially reducing their autonomy. This step has further alarmed investors, who view it as another effort to consolidate power and undermine the country’s institutional checks and balances.

While AMLO has fostered certain business partnerships, such as infrastructure projects with Grupo Carso, owned by Carlos Slim, his relationship with foreign companies has been fraught. Recent actions against international corporations, including a $6.2 billion deal with Spain’s Iberdrola to purchase power plants, have heightened concerns. AMLO has also threatened U.S.-based Vulcan Materials over a limestone quarry and clashed with China’s Ganfeng Lithium Group over control of a lithium mine.

Despite assurances from AMLO’s government that the reform will strengthen democracy, critics argue that it will politicize the judiciary and create legal instability, making Mexico a less attractive destination for foreign direct investment. The potential for judges to be swayed by political pressure under a popular vote system raises concerns over impartiality, further eroding investor confidence.

The reforms also risk undermining Mexico’s nearshoring advantage. Companies attracted to the country’s proximity to the U.S. may begin to look elsewhere if legal certainty diminishes. With nearshoring contributing significantly to Mexico’s economy, a shift in business investments to countries like Vietnam or Colombia could pose long-term economic consequences.

As these reforms edge closer to becoming law, Mexico’s standing as a favorable destination for foreign investment is under scrutiny. Investors now face an uncertain future, wondering whether the promised changes will foster true democratic progress or lead the country back toward concentrated, unchecked political power.